People with a lump sum of cash needing a better return on their investment. This may include but not limited to the following:

Current Investors

People already invested in the stock market and other listed assets who are disappointed by the current returns.

Potential Property Investors

People that are interested in investing in property but either are not able to finance a second property invested i.e. get another mortgage bond form the bank because they already have a bonded property but may have some lump sum that they can invest into our project.

People that want to invest in property but do not want the hassle of managing the tenants and the property

Retirees

People that have retired and thus have received their pension pay-outs and are looking for somewhere to invest in order to supplement their pension/provident funds.

Provident Fund Recipients

People that have recently switched jobs and have cashed in their provident funds and are looking for somewhere to invest or make their money work for them.

Mavericks

High net worth individuals looking to reduce their tax burdens whilst also growing their money.

Home Owners

People with paid up or almost paid up homes who could refinance their homes and invest in a business. People invested in low-performing vehicles like fixed deposits in banks looking for a higher return on investment.

Inheritors

People who have recently received an inheritance and want to invest and grow their inheritance.

Money Makers

In a nutshell anybody that has cash and looking to make it grow!

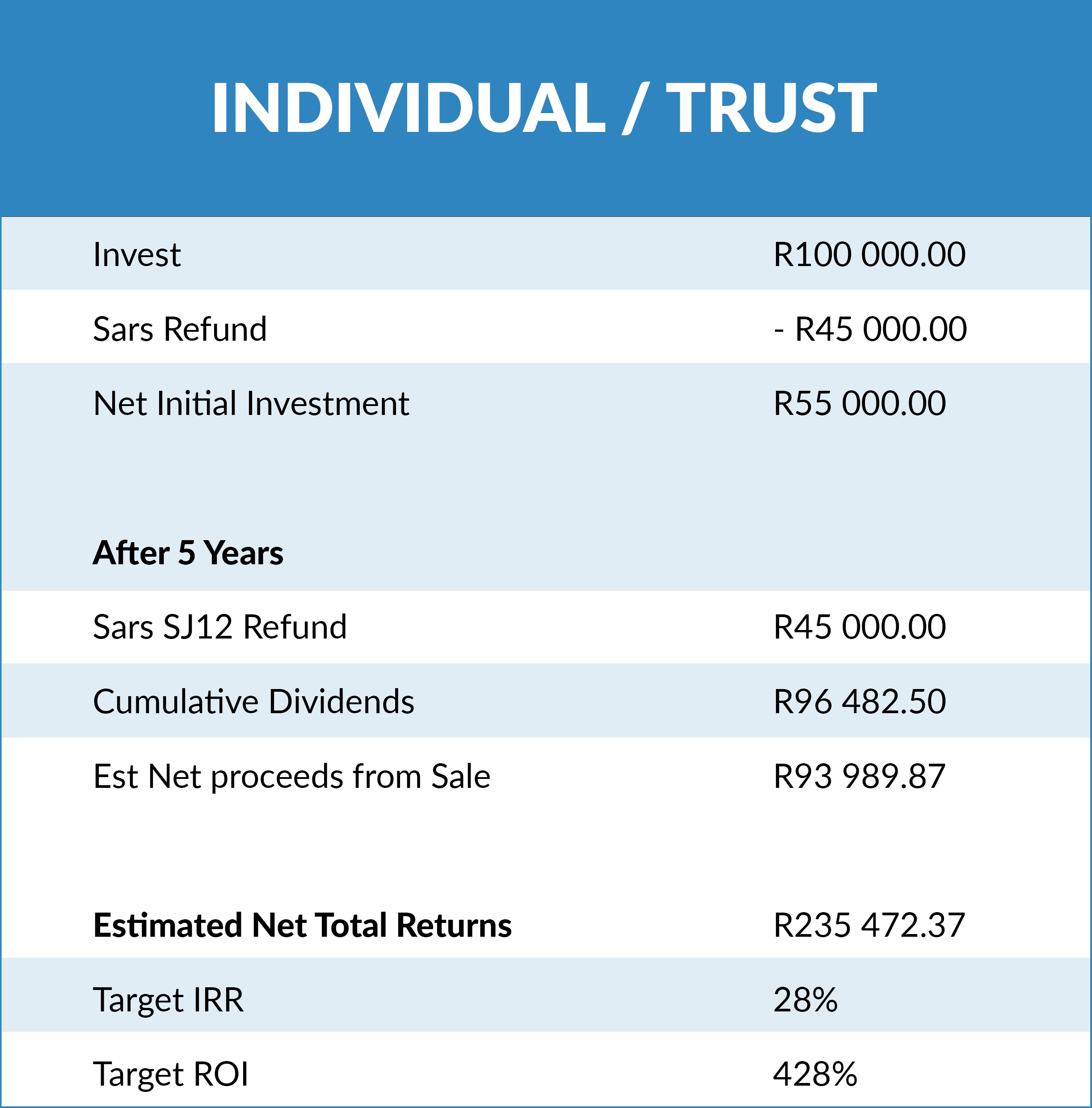

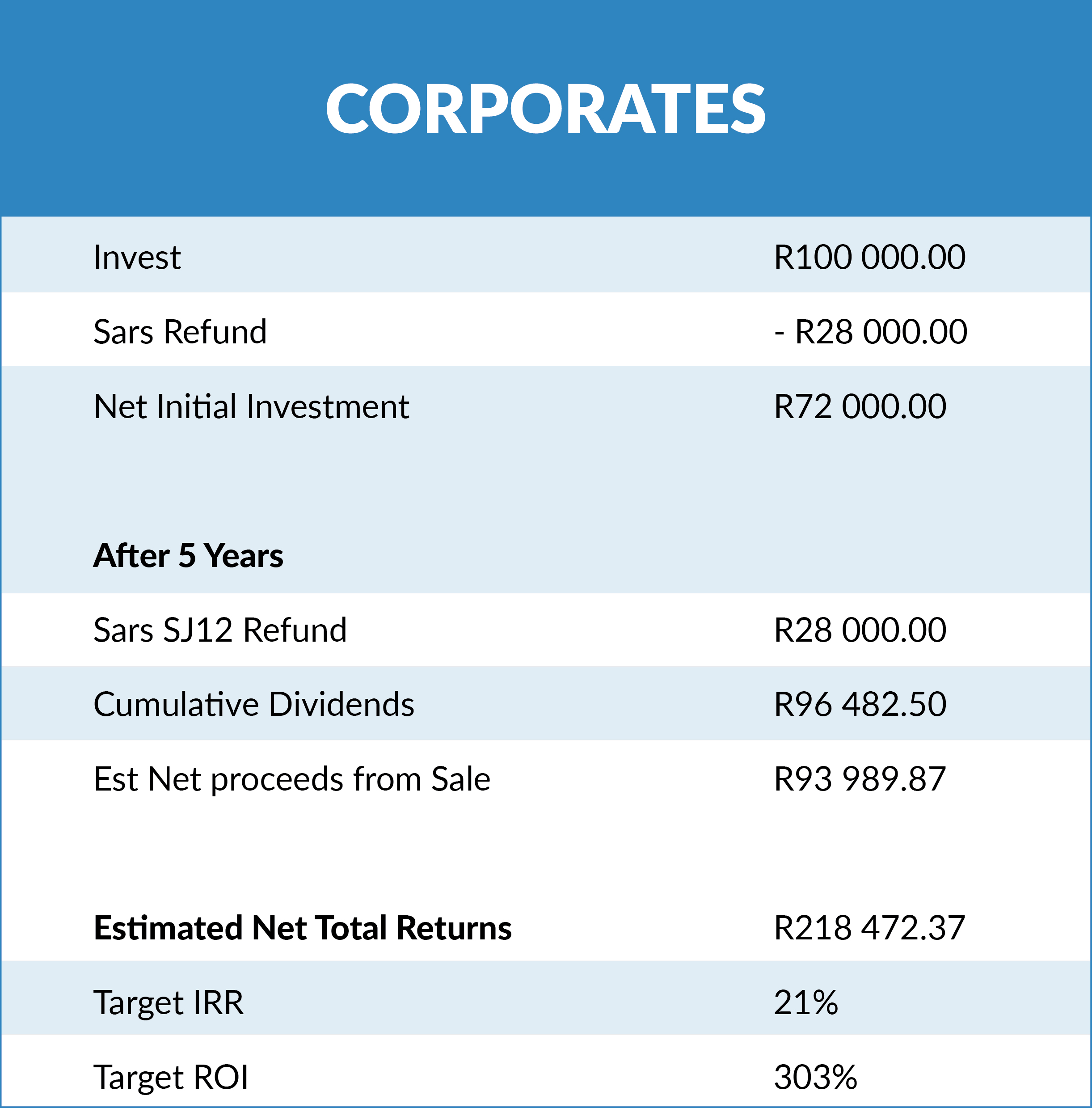

INVESTMENTS OF R 100, 000

Based on a R100, 000 Investment in a S12J Fund Investment and 5 to 7 year exit: The below is for illustrative purposes and the returns are proportionate to the amount invested. Based on a R100,000 S12J Fund Investment with 7 year exit.

This Example is based on a partnership structure and assumes the client utilises the highest Tax Bracket. Please consult your financial adviser before making an investment.